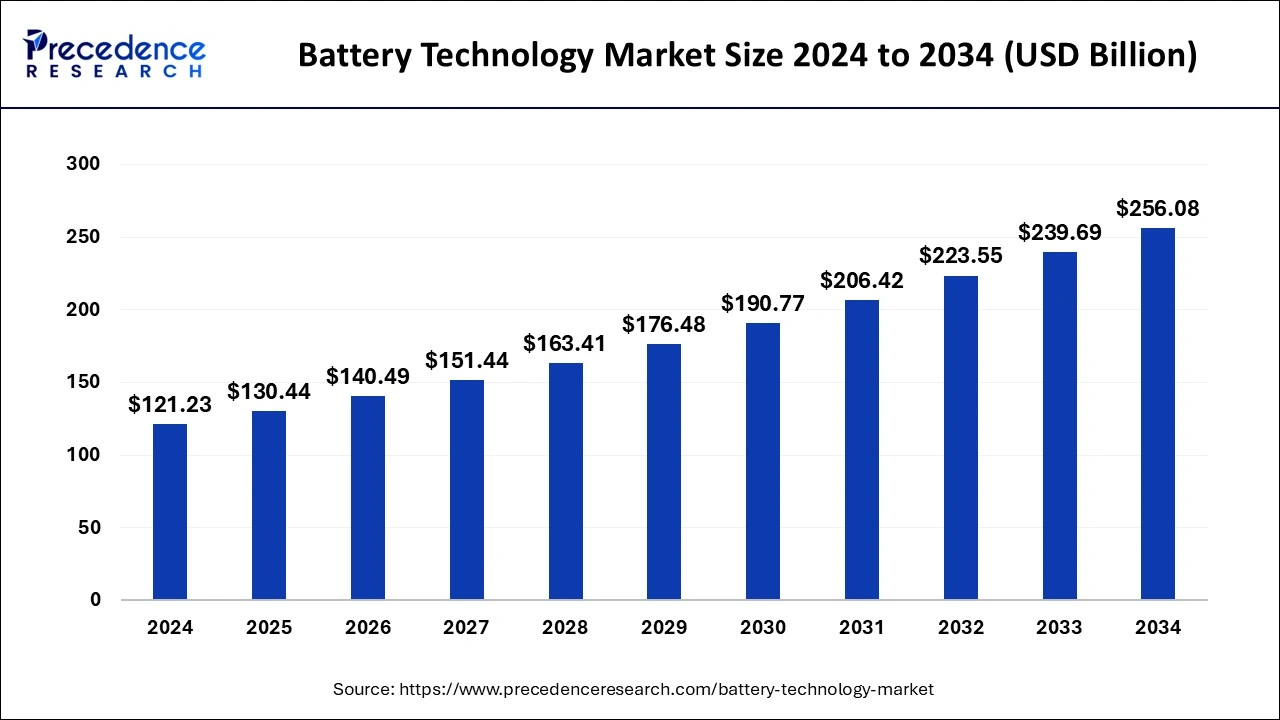

Battery Technology Market Size Worth USD 256.08 Billion by 2034

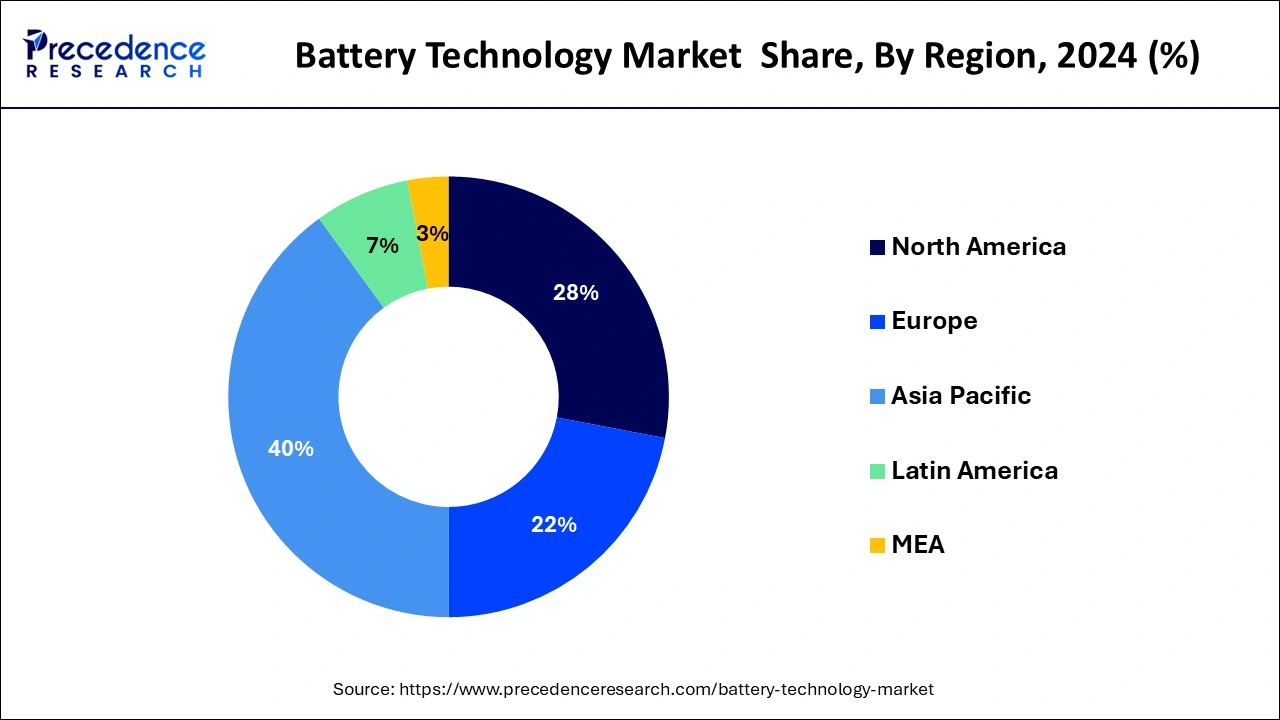

According to Precedence Research, the global battery technology market size will grow from USD 130.44 billion in 2025 to nearly USD 256.08 billion by 2034, with an expected CAGR of 7.76% from 2025 to 2034. In 2024, Asia Pacific led the global market with a 40% share, while North America is expected to witness significant growth during the forecast period.

Ottawa, Oct. 28, 2025 (GLOBE NEWSWIRE) -- The global battery technology market size is expected to be worth over USD 256.08 billion by 2034, increasing from USD 140.49 billion in 2026, growing at a strong CAGR of 7.76% between 2025 and 2034. The rise in the adoption of electric vehicles and the expansion of renewable energy drive the market growth.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1654

Battery Technology Market Highlights:

- Asia Pacific accounted for the major market share of 40% in 2024.

- North America is expected to grow at a strong CAGR during the forecast period.

- By product type, the lithium-ion batteries segment contributed the highest market share in 2024.

- By product type, the lead acid segments is growing at a notable CAGR during the forecast period.

- By application, the automotive segment held the largest market share in 2024.

- By application, the consumer electronic segment is expanding at a sloid CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 130.44 Billion

- Market Size in 2026: USD 140.49 Billion

- Forecasted Market Size by 2034: USD 256.08 Billion

- CAGR (2025-2034): 7.76%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is Battery Technology?

Battery technology market growth is driven by the increasing need for energy storage systems, the rise in electrification of industrial equipment, growing sales of electric vehicles, increasing adoption of wind energy & solar energy, and rising utilization of portable electronic devices.

Battery technology is the process of advancement, design, & development of energy storage devices that consist of an electrolyte, anode, & cathode. These devices convert chemical energy into electrical energy. The different forms of batteries are non-rechargeable and rechargeable, like lead-acid batteries & lithium-ion batteries.

What are the Applications of Battery Technology?

| Application | Used For | Functions |

| Consumer Electronics |

|

|

| Transportation |

|

|

| Energy Storage |

|

|

| Medical |

|

|

➤ Get the Full Report @ https://www.precedenceresearch.com/battery-technology-market

Major Government Initiatives in the Battery Technology Industry:

-

Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Battery Storage: This initiative provides financial incentives to companies for setting up large-scale, giga-scale ACC manufacturing facilities in the country. The scheme's goal is to reduce import dependence and make India a globally competitive hub for battery manufacturing.

-

Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) Scheme: The FAME scheme offers demand incentives, such as upfront cost reductions, to encourage consumers to buy electric vehicles and to support the establishment of EV charging infrastructure. By creating market demand and providing incentives for both vehicles and infrastructure, the scheme drives the growth of the entire EV ecosystem, including battery technology.

-

National Mission on Transformative Mobility and Battery Storage: Established to drive strategies for clean, sustainable mobility, this mission oversees initiatives that support the phased manufacturing of EVs and batteries. Its objective is to enable India to develop a competitive domestic manufacturing ecosystem and reduce its oil import dependence.

-

Battery Waste Management Rules: These rules implement an Extended Producer Responsibility (EPR) framework for battery producers, requiring them to collect and recycle waste batteries. This initiative promotes a circular economy and reduces dependence on imported raw materials for battery production.

-

Investment and R&D Support: Various government bodies, like the Department of Science and Technology (DST), provide grants and support for battery technology research and development. These programs foster innovation in cutting-edge technologies, such as solid-state batteries, and encourage collaborations between academic institutions and private industry.

Major Trends in the Battery Technology Market

- Rise of next-generation battery chemistries: There is significant research and investment in alternatives to conventional lithium-ion batteries, such as solid-state and sodium-ion batteries, to improve safety, cost, and energy density.

- Increased focus on battery recycling and second-life applications: To create a more circular economy and secure critical materials, companies are developing new technologies and business models for recycling end-of-life batteries and repurposing them for other uses, like grid storage.

- Localization of battery supply chains: Driven by geopolitical and economic considerations, countries and regions like the US and Europe are heavily investing in domestic battery production and processing to reduce reliance on foreign supply chains.

- Advancements in safety and battery management systems (BMS): Innovations in thermal management, fire-resistant materials, and software are enhancing battery safety and lifespan, especially for high-energy-density applications like electric vehicles.

-

Integration of AI and machine learning: Artificial intelligence is being used to optimize battery design, predict performance, and improve manufacturing processes, accelerating the development of more efficient and reliable batteries.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Battery Technology Market Opportunity

Growing Electric Vehicle Adoption Surges Demand for Battery Technology

The stricter emission regulations and increasing adoption of electric vehicles increase demand for battery technology. The strong government support for EV adoption and increasing consumer interest in zero-emission vehicles require battery technology. The development of public charging infrastructure requires battery technology.

The growing adoption of electric passenger cars, three-wheelers, two-wheelers, and trucks requires battery technology. The strong consumer focus on cleaner vehicles and the presence of battery recycling technology increase the adoption of electric vehicles, which requires battery technology. The growing adoption of electric vehicles creates an opportunity for the growth of the battery technology market.

Battery Technology Market Challenges and Limitations:

High Manufacturing Cost

Despite several benefits of battery technology across various industries, the high manufacturing cost restricts the market growth. Factors like costly components, expensive raw materials, high precision, energy-intensive process, and use of advanced technology are responsible for the high manufacturing cost.

The high cost of feedstocks like nickel, lithium, & cobalt, and expensive cathode active material increases the cost. The multi-step manufacturing process and the need for expensive machinery increase the cost. The stricter quality control and need for molecular-level precision require a high cost. The high manufacturing cost hampers the growth of the battery technology market.

Battery Technology Market Report Scope

| Report Attributes | Details | |

| Market Size in 2024 | USD 121.33 Billion | |

| Market Size in 2025 | USD 130.44 Billion | |

| Market Size in 2026 | USD 140.49 Billion | |

| Market Size in 2034 | USD 256.08 Billion | |

| CAGR from 2025 to 2034 | 7.76% | |

| Leading Region in 2024 | Asia Pacific | |

| Fastest Growing Region | North America | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Product, Application, Control Technologies, Power Systems, and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1654

Case Study: EV OEM’s APAC Gigafactory + North American Second-Life ESS Program

A global EV OEM used APAC manufacturing scale for first-life lithium-ion packs and built a North American second-life energy-storage program. Outcome: sub-$95/kWh pack cost, 18-month time-to-capacity, and 42% LCOE reduction for grid storage—mirroring 2024 APAC leadership and NA’s fastest-growth trajectory cited in the release.

Company Profile

- Industry: Automotive and stationary energy storage

- Footprint: Cell/packs in China and India; vehicle assembly in Thailand and Japan; ESS deployment in the U.S. and Canada

- Product scope: NMC and LFP lithium-ion packs (EV); repurposed LFP modules (ESS); VRLA backup for critical facilities in LATAM

Challenge

- EV side: Reduce pack $/kWh and charging time while meeting 8-year warranty targets.

- ESS side: Offset capex for utility-scale storage amid raw-material cost volatility; comply with battery-waste rules and EPR.

- Operations: Localize supply chains, raise yields, and stand up recycling to close the loop.

Strategy

- APAC scale-up (first-life): 12 GWh LFP line in India + 8 GWh NMC line in China; automated formation, AI-assisted BMS calibration; thermal propagation barriers aligned to new safety norms.

- NA circularity (second-life): Collect EV packs after ~70–80% SOH; module-level grading; repurpose to 2- to 4-hour grid ESS; integrate with U.S. utility interconnection standards.

-

Chemistry fit:

- LFP for mass-market EVs and ESS (cost, safety, cycle life).

- NMC for premium EV range targets.

- VRLA retained for selected data-center UPS retrofits where low capex and high recycling rates were prioritized.

- Digital layer: Fleet telematics → cell-level prognostics; manufacturing SPC + computer vision scrap detection; BMS OTA updates to optimize charge protocols.

- Compliance & incentives: Leveraged APAC manufacturing incentives, U.S. clean-energy credits, and EPR-aligned take-back with certified recyclers.

Implementation timeline

- Q2’24–Q1’25: Line commissioning; PPAP for three vehicle platforms; UL/IEC certifications for ESS racks.

- Q2’25–Q4’26: Ramp to 80% utilization; launch second-life pilot (20 MWh), then scale to 180 MWh across three U.S. substations.

-

2027+: Add solid-state coin-cell R&D pilot; expand automated disassembly for end-of-life packs.

Results (12–24 months post-launch)

EV manufacturing (APAC)

- Pack cost: $129 → $94/kWh (−27%) via yield + logistics + cell sourcing.

- Fast-charge: 10–80% in 23 min → 16 min after BMS/thermal updates (LFP).

- Warranty: Early-life capacity claims −38%; thermal incidents 0.

- Throughput: +22% output per line after formation-time optimization.

- CO₂e: −18% per kWh from localized cathode supply and renewable PPAs.

Grid ESS (North America)

- Second-life module reuse rate: 73% of returned modules met SOH spec.

- LCOE: −42% vs new-cell ESS; capex −36% per installed kWh.

- Round-trip efficiency: 76–79% (second-life LFP) with 10-year augmentation plan.

- Interconnection curtailment losses: −15% after EMS forecasting upgrade.

- Compliance: 100% traceability under EPR; recovery of lithium, nickel, cobalt where applicable; >92% lead recovery on VRLA streams.

Why this maps to the release

- APAC lead (40% in 2024): Cost and yield gains came from APAC gigafactory scale and supply depth.

- NA fastest growth: ESS expansion and policy tailwinds drove the quickest revenue lift.

- Product segmentation: Li-ion (LFP/NMC) dominated value; VRLA showed notable growth in UPS retrofits.

- Applications: Automotive delivered the largest revenue; consumer-electronics learnings informed BMS optimizations; power & utility captured second-life value.

-

CAGR logic (2025–2034: 7.76%): Cost curves, safety innovations, recycling, and localized chains sustained double-digit program IRR while aligning with the market trajectory.

Operational Playbook

- Lock multi-year LFP cathode offtake; dual-source graphite/anode.

- Design packs for disassembly at module level to enable second-life grading.

- Embed SOH telemetry at cell level from day one; gate reuse by IR and hysteresis metrics.

- Standardize rack voltage windows (e.g., 1000 VDC class) to simplify site engineering.

- Pre-contract recycler capacity; tie EPR reporting to MES/ERP lot codes.

KPI Snapshot

| Domain | Baseline | Post-program | Delta |

| Pack cost ($/kWh) | 129 | 94 | −27% |

| Fast-charge 10–80% (min) | 23 | 16 | −30% |

| Yield (cell→pack) | 89% | 95% | +6 pp |

| ESS LCOE ($/MWh) | 163 | 94 | −42% |

| Second-life acceptance | — | 73% modules | — |

| Warranty claims (rate) | 1.6% | 1.0% | −38% |

Takeaways

- Scale in APAC for cost/throughput; monetize in North America via ESS and policy support.

- Favor LFP for safety + reuse; deploy NMC selectively for premium range.

- Engineer circularity early—design, data, disassembly, and contracted recycling close the economics.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

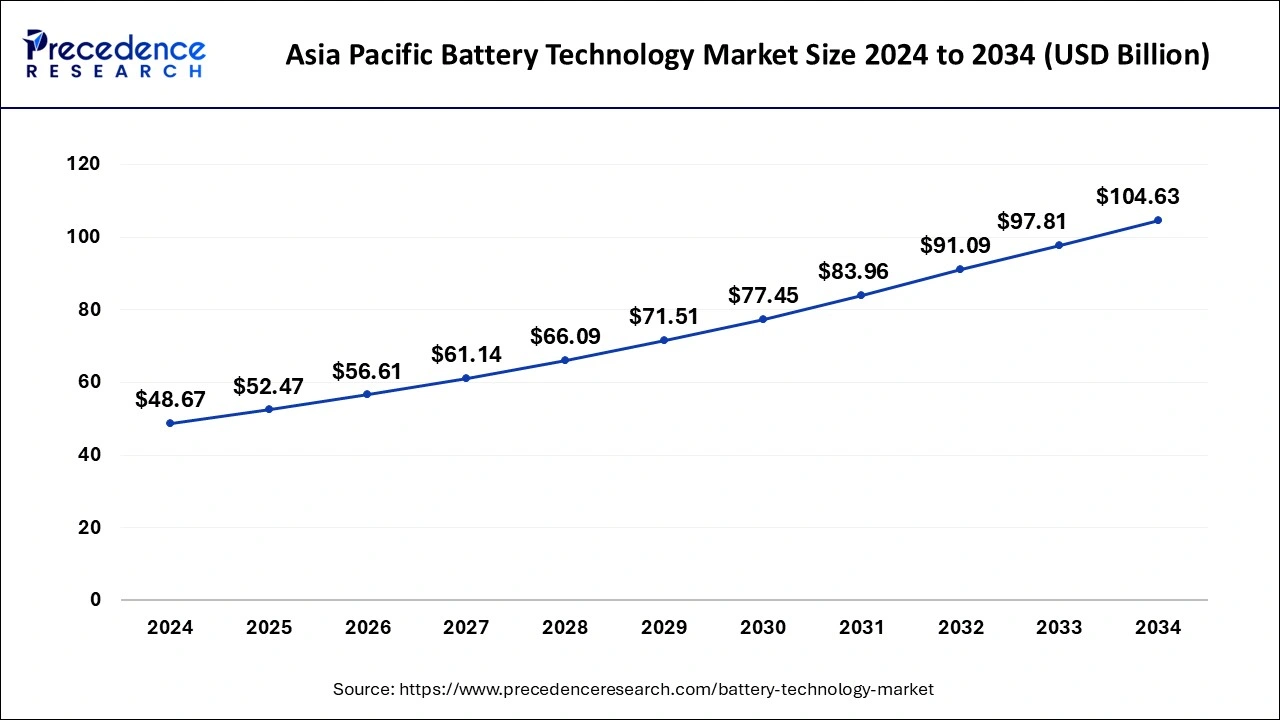

What is the Asia Pacific Battery Technology Market Size?

According to Precedence Research, the Asia Pacific battery technology market size is predicted to rise from USD 52.47 billion in 2025 to nearly USD 104.63 billion by 2034, with an expected CAGR of 7.95% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/checkout/1654

The Powerhouse: How Asia Pacific Charges Ahead in the Battery Race

Asia Pacific dominated the market with a 40% share in 2024. The rise in the adoption of electric vehicles and the increased manufacturing of commercial vehicles increases demand for battery technology. The growing expansion of solar & wind energy capacity and strong government support for electrification increase the adoption of battery technology. The increasing manufacturing of consumer electronics and industrial digitalization drives the overall market growth.

China Battery Technology Market Analysis

China dominates the regional market due to its comprehensive strategy combining significant government support, control over the entire supply chain, rapid scaling of manufacturing, and continuous innovation. The government has provided massive subsidies, tax breaks, and long term policies, such as including battery technology it’s made in China 2025 plan, to nurture domestic battery manufacturers like CATL and BYD.

Power Play: The Global Stakes Behind the Battery Technology Boom

North America is experiencing the fastest growth in the market during the forecast period. The surge in wind & solar power projects and strong government support for the development of charging infrastructure require battery technology. The growing manufacturing of electronic devices like wearables, smartphones, computers, and laptops increases the adoption of battery technology. The growing adoption of electric vehicles and the expansion of battery energy storage systems support the overall growth of the market.

The U.S. Battery Technology Market Trends

The U.S. dominates the regional market because it has the largest electric-vehicle industry, strong manufacturing capabilities, and a robust ecosystem of battery R&D and innovation. The country benefits from major investments in lithium-ion battery production capacity, advanced supply-chain development, and leading companies pushing technological improvements in energy density, performance, and safety. Government policies and incentives supporting EV adoption and local battery production have further accelerated growth.

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Battery Technology Market Segmentation Insights:

Product Type Insights

Why the Lithium-Ion Batteries Segment is Dominating the Battery Technology Market?

The lithium-ion batteries segment dominated the battery technology market in 2024. The rise in the manufacturing of electric vehicles and a strong government support for cleaner energy increase demand for lithium-ion batteries. The development of laptops, computers, smartphones, and other smart devices requires lithium-ion batteries. The faster charging, high energy density, & long cycle life of lithium-ion batteries drive the overall growth of the market.

The lead acid segment is the fastest-growing in the market during the forecast period. The development of data centers and the rise in electric vehicles increases demand for lead-acid batteries. The increasing remote solar installations and the growing manufacturing of hybrid vehicles require lead-acid batteries. The cheaper manufacturing cost and high recycling rate of lead-acid batteries support the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the Battery Technology Market?

The automotive segment held the largest revenue share of the battery technology market in 2024. The rise in the adoption of electric vehicles and the development of hybrid vehicles increases demand for battery technology. The strong government support for EV manufacturing and the development of advanced driver assistance system (ADAS) cars requires battery technology. The increasing use of vehicles like two-wheelers, passenger cars, & commercial trucks requires battery technology, driving the overall market growth.

The consumer electronics segment is experiencing the fastest growth in the market during the forecast period. The increased utilization of electronic devices like laptops, wearables, smartphones, and tablets increases demand for battery technology. The strong focus on the better performance of electronic devices and the development of power-intensive features requires battery technology. The expansion of internet of things (IoT) and the growing miniaturization of electronic devices support the overall market growth.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

✚ Related Topics You May Find Useful:

➡️ Advanced Li-ion Battery Technologies Market: Explore how next-generation chemistries are powering the evolution of high-performance energy storage systems.

➡️ Lithium Iron Phosphate Battery Market: See why safer, cost-efficient LFP batteries are reshaping the global EV and stationary storage landscape.

➡️ Electric Vehicle Battery Market: Analyze key innovations driving longer range, faster charging, and sustainable battery production in the EV sector.

➡️ Li-ion Battery Management Systems Market: Understand how smart BMS solutions ensure efficiency, safety, and extended life cycles for lithium-ion batteries.

➡️ Battery Leasing as a Service Market: Discover how subscription-based battery ownership models are transforming the EV ecosystem.

➡️ Flexible Battery Market: Track the rise of bendable, ultra-thin batteries powering wearables, medical devices, and next-gen electronics.

➡️ Second-Life Electric Vehicle Batteries Market: Learn how repurposed EV batteries are fueling the circular economy and renewable energy storage systems.

➡️ Advanced Battery Market: Examine how solid-state, flow, and hybrid batteries are redefining the future of global energy storage.

➡️ High Voltage Battery Market: Delve into the growing demand for high-voltage systems in electric mobility and industrial power solutions.

➡️ Battery Energy Storage System Market: Gain insights into the expanding role of BESS in stabilizing renewable grids and enabling energy transition.

➡️ Battery Electrolyte Market: Investigate the chemical breakthroughs enhancing performance, safety, and energy density in modern batteries.

➡️ Battery Binders Market: Discover how advanced binder materials are improving electrode adhesion, flexibility, and longevity in battery cells.

➡️ Advanced Battery Market: See how innovations in solid-state, lithium-sulfur, and sodium-ion technologies are shaping the next energy revolution.

Competitive Landscapes in Battery Technology Market

Corporate information

- Headquarters: Tokyo, Japan

- Year Founded: 1960

-

Ownership Type: Public (listed on the Tokyo Stock Exchange)

History and background

- Origin: Maxell was founded in 1960, with its name stemming from "Maximum Capacity Dry Cell". It was initially a spin-off from Nitto Electric Industrial Company's battery and magnetic tape divisions.

- Connection to Hitachi: The company was a consolidated subsidiary of Hitachi, Ltd. from 2010 but was later relisted on the Tokyo Stock Exchange in 2014. The company name was officially changed to Maxell, Ltd. in 2021.

Key milestones / Timeline (in battery technology)

- 1963: Commenced production of Japan's first alkaline dry batteries.

- 1976: Commercialized Japan's first silver oxide batteries.

- 1996: Started production of lithium-ion rechargeable batteries.

- 2019: Commenced shipping samples of coin-shaped all-solid-state batteries.

-

2023: Started mass production of ceramic-packaged sulfide-based all-solid-state batteries.

Business overview

Maxell focuses on developing advanced battery technologies, with an emphasis on high performance and reliability across various applications. The company has invested heavily in research and development, particularly for next-generation solid-state batteries, and is expanding its industrial market presence.

Business segments / Divisions

- Energy: Focuses on developing and manufacturing lithium-ion rechargeable batteries, micro-batteries, and other energy storage devices for a wide range of applications.

- Functional Materials: Leverages proprietary material technologies for battery components and other electronic parts.

- Optics & Systems: Includes products like lens units and other optical components.

- Life Solutions: Covers consumer electronics and health-related products.

Geographic presence

Maxell operates on a global scale with manufacturing sites and sales offices across Asia, Europe, and North America. Key locations include Japan (Tokyo, Kyoto, Osaka), China, Thailand, Malaysia, Indonesia, the US, and the UK.

Key offerings (in battery technology)

- Primary Batteries: Offers a variety of disposable batteries, including alkaline dry batteries and micro-batteries for small devices.

- Rechargeable Batteries: Produces conventional lithium-ion rechargeable batteries for both consumer and industrial use.

- Solid-State Batteries: Is a leader in the development and mass production of all-solid-state batteries, known for their high safety and reliability.

- Battery Materials and Components: Provides battery materials, electroforming, and precision components.

-

Energy Storage Solutions: Develops and offers systems for industrial and residential use.

End-use industries served

- Automotive: Supplies batteries for applications like Tire Pressure Monitoring Systems (TPMS), as well as lens units for cameras and headlamps.

- Healthcare and Medical: Provides batteries for medical devices, hearing aids, and other health-related products.

- Consumer Electronics: Supplies batteries for smartphones, wearable devices, watches, calculators, and other small gadgets.

- Industrial Equipment: Provides batteries for a variety of industrial and portable equipment.

-

Infrastructure: Offers batteries for applications like smart meters, IoT sensors, and wireless networks.

Recent news and updates

- October 2025: Maxell began sample shipments of its heat-resistant all-solid-state battery for use up to 150°C, marking a significant advancement for industrial and automotive applications.

- September 2025: The company launched new all-solid-state battery modules and evaluation kits to accelerate adoption in industrial and IoT sectors. Maxell's solid-state battery modules were also deployed for testing in industrial robots at a Subaru plant.

2. Exide Corp.

Corporate Information

- Headquarters: Kolkata, West Bengal, India

- Year Founded: 1947 (in its current form)

-

Ownership Type: Public (listed on the National Stock Exchange of India)

History and Background

- Origin: The company's origins can be traced to the 1920s with the import and assembly of Exide batteries by Chloride Electrical Storage Company (CESCO). It was formally incorporated as Associated Battery Makers (Eastern) Limited in 1947.

- Evolution: Over the decades, the company expanded its manufacturing and R&D capabilities, acquiring other battery businesses and steadily modernizing its operations.

-

Trademark Resolution: After a prolonged legal battle with the US-based Exide Technologies, Exide Industries secured exclusive rights to the "Exide" trademark in the Indian market.

Key Milestones / Timeline

- 1947: First factory established in Shyamnagar, West Bengal.

- 1969: Second factory opened in Chinchwad, Maharashtra.

- 1976: Established a premier R&D center in Kolkata.

- 1995: Name officially changed to Exide Industries Limited.

- 2022: Forayed into lithium-ion battery manufacturing through its subsidiary Exide Energy Solutions Limited.

- 2024: Began work on a 12 GWh greenfield lithium-ion cell manufacturing plant in Bengaluru, Karnataka.

-

2025: Set up new battery energy storage system projects.

Business Overview

Exide is a market leader in providing stored energy solutions, with a dominant position in the traditional lead-acid battery market and a growing presence in advanced lithium-ion technologies. The company focuses on a dual-pronged strategy: consolidating its core lead-acid battery business while aggressively investing in next-generation battery solutions for the EV and renewable energy markets.

Business Segments / Divisions

- Lead-Acid Batteries: This remains the core business, serving a vast array of applications in the automotive and industrial sectors.

- Home UPS Systems: The company manufactures inverters and home UPS systems.

- Lithium-ion Batteries: Through its subsidiary, Exide Energy Solutions, the company is involved in the manufacturing of lithium-ion cells, modules, and packs.

- Battery Recycling: Exide, via its subsidiary Chloride Metals, operates lead recycling facilities, promoting a circular economy approach.

Geographic Presence

- Domestic: Operates a widespread network of manufacturing facilities across multiple states in India.

- International: Maintains a global presence through subsidiaries in the UK, Singapore, and Sri Lanka, and exports its products to over 60 countries.

Key Offerings

- Automotive Batteries: Provides a wide range of batteries for two-wheelers, passenger vehicles, commercial vehicles, and e-rickshaws.

- Industrial Batteries: Supplies batteries for various applications, including telecom, power infrastructure, railways, and defense.

- Home Power Solutions: Offers inverter and home UPS batteries.

- Advanced Batteries: Developing and supplying lithium-ion batteries and battery packs, along with battery management systems.

End-Use Industries Served

- Automotive: Supplies Original Equipment Manufacturers (OEMs) and the aftermarket segment.

- Power and Infrastructure: Serves power generation, renewable energy projects, and telecommunications.

- Railways and Defense: Provides specialized batteries for railways and the Indian military.

- Consumer: Caters to the consumer segment with its home UPS and inverter batteries.

-

Electric Mobility: Expanding to serve the growing EV market for 2-wheelers and 3-wheelers with its lithium-ion solutions.

Recent news and updates

- Lithium-ion Plant on Track: In the first quarter of FY26, Exide announced its new Bengaluru lithium-ion manufacturing plant is on track for commercialization by the fiscal year-end, with construction and equipment installation nearing completion.

- Increased Lithium-ion Investment: Exide has invested an additional ₹80 crore in its subsidiary, Exide Energy Solutions, to support the Bengaluru plant's development, bringing the total investment to over ₹3,882 crore.

Industry recognitions and awards

- British Safety Council International Awards 2025: Exide's Hosur and Ahmednagar facilities received this award for their commitment to Environmental, Health, and Safety (EHS) standards.

- Top Digital Enterprise in Manufacturing: The Economic Times recognized Exide as the 'Top Digital Enterprise of India in Manufacturing' at its ET CIO Awards 2025.

Top Companies in the Battery Technology Market

-

American Battery Technology Company (ABTC) - ABTC focuses on a closed-loop system for battery metals, encompassing lithium-ion battery recycling, resource development from claystone, and the manufacturing of battery-grade metals.

-

Honda Inc. - Honda is developing next-generation, high-performance all-solid-state batteries for use in electric vehicles, which aim to provide higher energy density, faster charging, and improved safety.

-

China Bak Battery, Inc. (CBAK) - CBAK manufactures lithium-based battery cells for a range of uses, including electric vehicles, energy storage, and consumer electronics like smartphones and notebooks.

-

Sony Corp. - While Sony previously sold its lithium-ion battery manufacturing business, the company still offers rechargeable batteries, including lithium-ion, for its line of consumer electronics such as digital cameras and camcorders.

-

Fujitsu Ltd - Fujitsu has developed advanced cathode materials for lithium-ion and solid-state batteries, such as a high-voltage iron-based material, and is involved in research to produce safer, high-capacity, next-generation batteries.

-

General Electric Co. (GE) - Through its spin-off GE Vernova, GE provides grid-scale Battery Enabled Energy Storage (BESS) systems for utility-scale projects and offers battery and hybrid technologies for the transportation and stationary power sectors.

-

Google Inc. - Google's battery technology offering is not a product it manufactures, but rather an investment and strategic partnership with Energy Dome to deploy its CO2 Battery, a long-duration thermal energy storage solution for grid-scale renewable power.

- Honeywell Batteries - Honeywell's energy technology primarily focuses on grid-scale, long-duration energy storage systems, such as an iron-flow battery that uses iron, salt, and water for a safer and more durable solution compared to traditional batteries.

Recent Developments

- In October 2025, CATL launched the Shenxing Pro battery and No Propagation battery technology platform in Europe. The platform consists of 8 core technologies, and Shenxing Pro battery offers a supercharged & long-life version. (Source: https://chargedevs.com)

- In October 2025, Toshiba launched a new SCiB 24V lithium-ion battery pack. The battery is useful in applications like heavy equipment, automotive, and marine. The battery packs deliver 11.52 kWh of energy and lower environmental impact. (Source: https://emobilityplus.com)

- In July 2025, Varroc launched 8 new Valve Regulated Lead Acid batteries for two-wheelers. The battery consists of a 48-month warranty and has more than four years of service life. The battery minimizes corrosion and is made up of calcium alloy & 99.99% active material. (Source: https://ackodrive.com)

- In July 2025, Kalmar launched the next-generation lithium-ion battery technology for electric counter balanced equipment. The battery technology is useful in equipment like forklifts, reachstackers, & empty container handlers. The battery technology offers a longer shelf life and enhanced energy capacity. (Source: https://www.kalmarglobal.com)

Recent Industry Development: NavPrakriti Launches Lithium-Ion Battery Recycling Plant in Eastern India

In October 2025, NavPrakriti announced the commencement of operations at its new lithium-ion battery recycling facility in Eastern India. The facility represents a major milestone in India’s transition toward a circular battery economy, addressing the growing volume of used batteries from electric vehicles, renewable energy storage systems, and consumer electronics.

The new plant is designed to recover valuable materials such as lithium, cobalt, and nickel from end-of-life batteries, thereby reducing dependency on raw material imports and minimizing environmental impact. The initiative aligns with the Indian government’s Battery Waste Management Rules and the broader national strategy to establish a sustainable and self-reliant energy ecosystem.

According to industry estimates, India will generate over 1.2 million used EV batteries annually by 2030, making large-scale recycling crucial for resource recovery and supply chain resilience. NavPrakriti’s project contributes to this goal by ensuring efficient collection, dismantling, and processing of battery waste in compliance with environmental standards.

This development highlights the accelerating pace of industrial and technological investment in Asia Pacific’s battery ecosystem. The region continues to lead the global market in manufacturing capacity, technological advancements, and recycling infrastructure—key drivers behind its dominant 40% market share in 2024.

Segments Covered in the Report

By Product Type

- Lead Acid Batteries

- Stationary

- Motive

- Flooded

- VRLA Battery

- Basic Lead Acid Battery

- Advanced Lead Acid Battery

- Lithium-ion Batteries

- Lithium Nickel Manganese Cobalt (LI-NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Titanate Oxide (LTO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- 0 to 3,000 mAH

- 3,000 to 10,000 mAH

- 10,000 to 60,000 mAH

- More Than 60,000 mAH

- Lithium-Metal Battery

- Nickel Metal Hydride Batteries

- Nickel Cadmium Battery

- Others

By Application

- Automotive

- Medical

- Residential & Commercial

- Industrial

- Consumer Electronics

- Power & Utility

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1654

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.